Having bad credit is no joke – it can seriously impact your ability to access financial services, and means routine financial decisions can have big, long-term consequences. This is especially true if you’re thinking of taking on new debt, where the choice between a personal loan and a payday loan can be a tricky one. So let’s consider both products and how they can help (or hinder) those with bad credit:

Personal Loans vs. Payday Loans: Speed

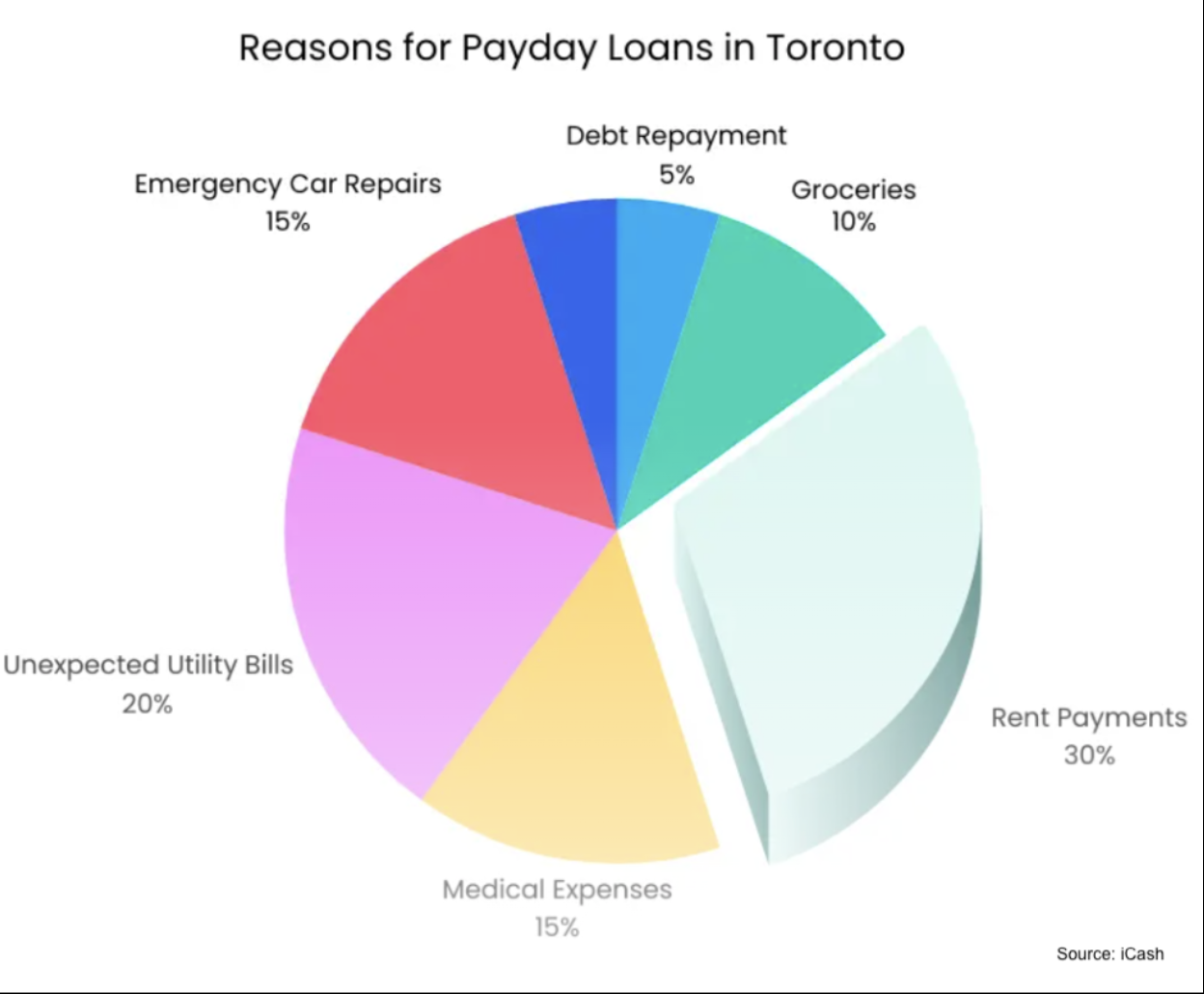

The primary reason Canadians turn to payday loans is speed, and this can be a benefit for anyone, regardless of credit score. Although most financial services companies and lenders in Canada now have customer-friendly online application systems, the paperwork needed to apply for a payday loan is much less than for a personal loan. And while it can take several days to several weeks for a personal loan decision, the majority of payday lenders offer decisions in less than a day.

However, this speed can have a downside: as payday loans are so quick to get, it can prevent consumers from properly considering their cost and repayment responsibilities. And getting any loan that you can’t afford to repay may negatively affect your credit, further exacerbating credit score difficulties.

Result: payday loans beat personal loans for speed, but this isn’t always an unqualified good.

Personal Loans vs. Payday Loans: Accessibility

Another key reason people use payday loans is accessibility. Personal loans take credit score into account when assessing applicants, making them harder to get for those with bad credit. Payday loans, on the other hand, do not take credit into account at all; instead, the primary factor when assessing applicants is income. This makes payday loans significantly easier to access for those with bad credit. But, as with speed, this accessibility can have a downside: just because a loan is easier to get, does not mean it’s the best financial decision.

Result: payday loans are much more accessible than personal loans for those with bad credit.

Personal Loans vs. Payday Loans: Cost

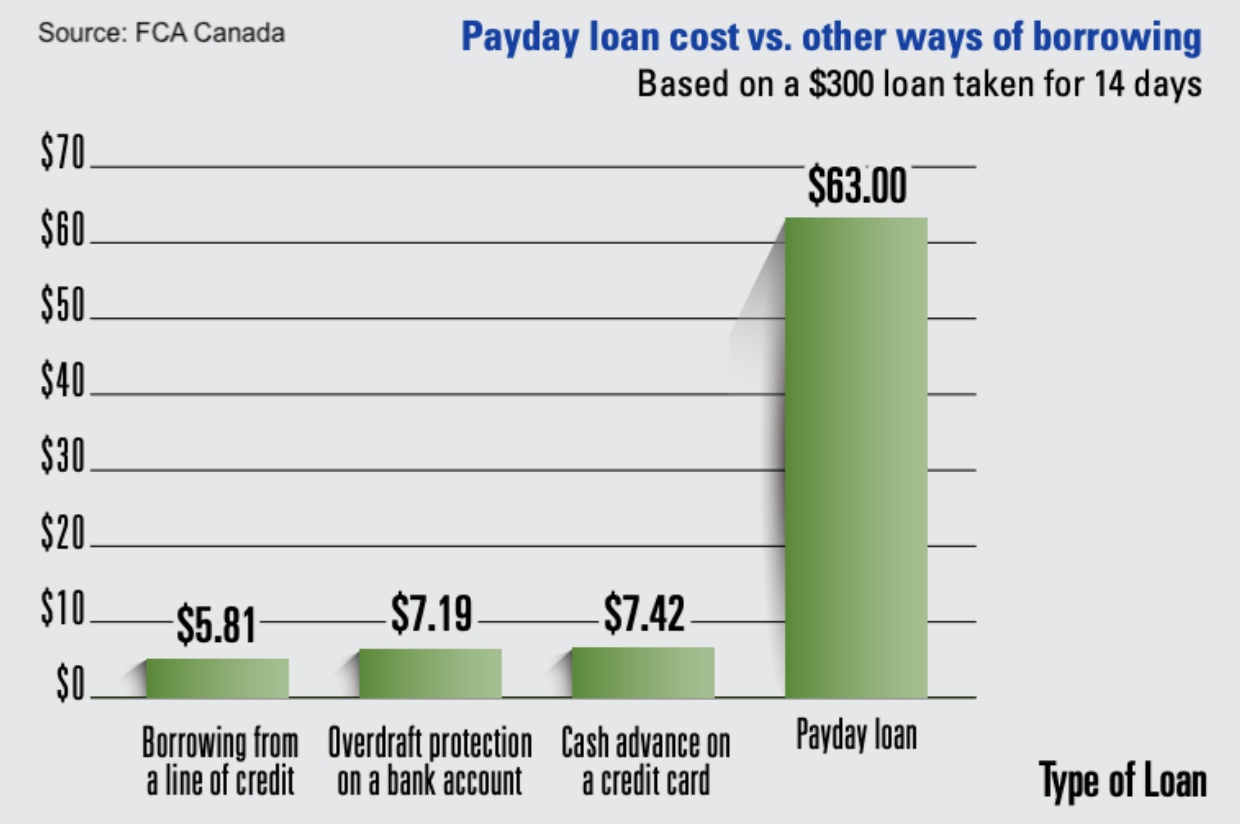

There is significant variety in the cost of personal loans, but it is generally the case that borrowers with poor credit will be charged higher interest rates than those with good credit. There are ways to ameliorate this though, and these can make personal loans more affordable, even for those with bad credit. Payday loans, on the other hand, have fixed costs (capped by the federal government), which are not dependent on credit, but could be more expensive.

Result: personal loans are more affordable than payday loans, which can help ensure those with bad credit do not worsen their financial difficulties.

Personal Loans vs. Payday Loans: Size

Personal loans come in all sizes, from $500 to $50,000 or more – although those with bad credit will struggle to qualify for large personal loans unless they can offer collateral or a guarantor. This flexibility in size is both a positive and a negative: it means borrowers can access larger sums of money, but as this money must be repaid (with interest), it can add financial pressure to people already struggling. Payday loans are by nature much smaller, typically just a few hundred dollars, and no more than $1,500. This means they’re not as useful as personal loans for big expenses, but they are easier to repay because they’re smaller.

Result: bad credit borrowers can usually borrow more with a personal loan than with a payday loan.

Personal Loans vs. Payday Loans: Credit Score

There is a crucial difference between payday loans and personal loans: the former are not reported to the credit bureaus, while the latter are. And adding debt to your credit profile can have a negative impact on your credit score, making an already low score even worse. This means that, when taking out a loan, a payday loan is the better option.

However, when it comes to loan repayments, the opposite is true. A history of repaying a personal loan properly can improve your credit score over time; but as payday loans are not reported to the credit bureaus, properly repaying a payday loan won’t. So for rebuilding credit, personal loans are the better option.

Result: failure to repay any loan will negatively affect your credit score; but it is only with a personal loan that proper repayments can help improve your credit.

Find out more about your payday loan options with Magical Cash; our transparent process and customer service experts can provide you with financial peace of mind.