No-credit-check loans are extremely popular among Canadians needing cash quickly, but they are certainly not the only option on the market. So why do people turn to these loans, and what are the alternatives? Let’s take a look:

What is a No-Credit-Check Loan?

Very simply, a no-credit-check loan is any type of loan whose approval does not depend on the applicant’s credit report. Every Canadian consumer has a credit report that details their financial history, and a credit score that is based on this history. Credit scores in Canada run from 300 (very poor) to 900 (excellent), with any score below 600 considered bad. Having a bad credit score can make it significantly harder for people to access loans, which is why many in this situation turn to no-credit-check loans.

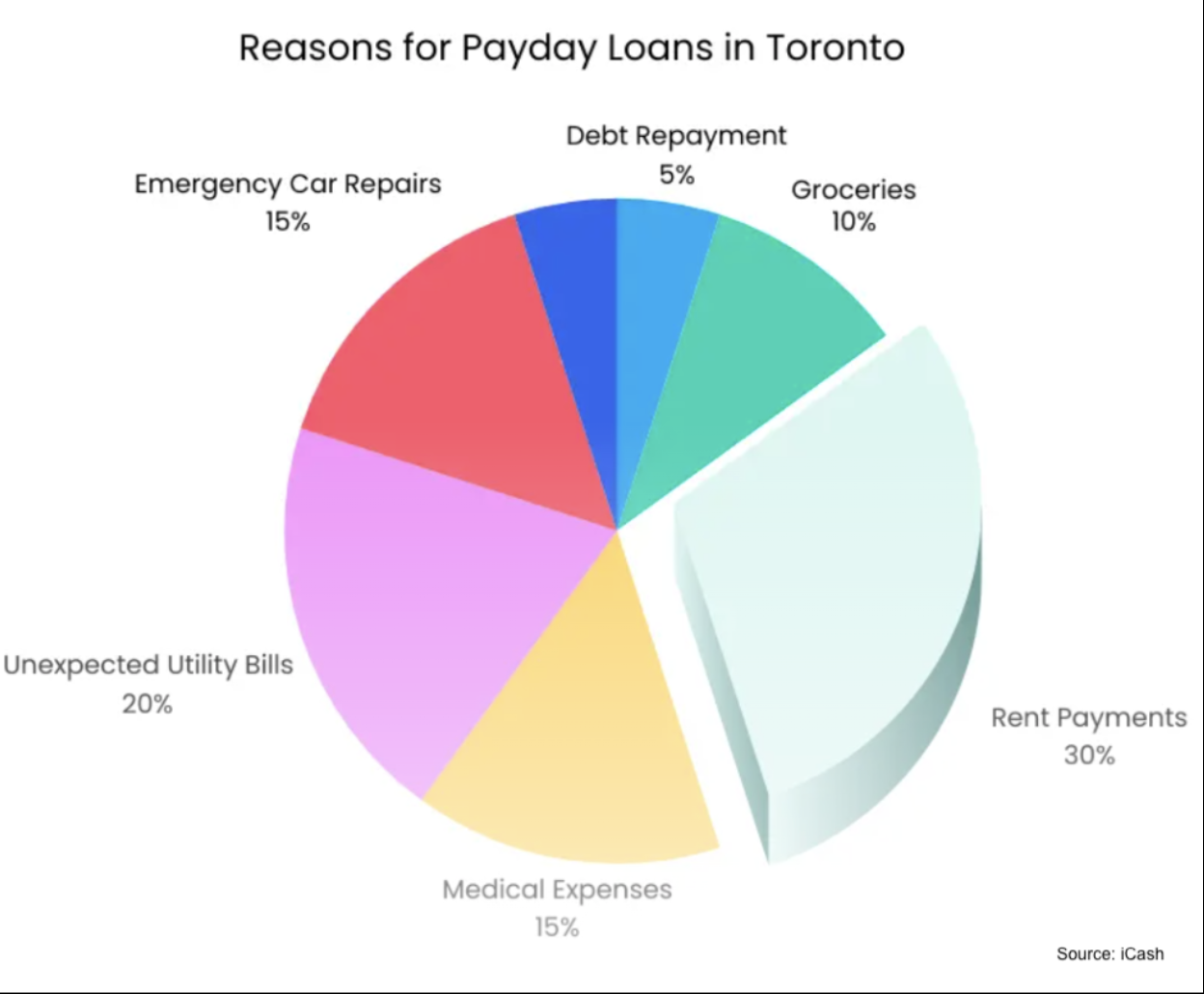

Instead of relying on credit score, no-credit-check loans depend on other factors, like income. By doing this, they provide access to financing for borrowers unable to qualify elsewhere. The most common form of personal no-credit-check loan is a payday loan.

Advantages of No-Credit-Check Loans

There are several key advantages of no-credit-check loans:

- Accessibility: No-credit-check loans are among the most accessible forms of borrowing on the market. There is no credit requirement; income requirements are usually generous (and are not necessarily related to employment), anyone with ID and a bank account can apply, and most lenders have online portals to apply for and manage loans.

- Speed: No-credit-check loans are also one of the quickest ways to get money; most lenders offer same-day or next-day processing, meaning you could get cash into your bank account within hours of applying.

- Minimal commitment: These are unsecured, short-term loans, so borrowers do not have to provide collateral and are only committing to a very short period of loan repayment.

- Cooling off period: It’s mandated by the Canadian government that all payday loans have a guaranteed two-day ‘cooling-off’ period, when a borrower can change their mind and cancel their loan, without incurring any costs.

- Consumer protections: The federal government and provincial governments also provide multi-layered consumer protection for the loan market, including for payday loan borrowers. This includes a cap on maximum borrowing costs.

Disadvantages of No-Credit-Check Loans

No form of borrowing is entirely without compromises though; the main disadvantages of no-credit-check loans include:

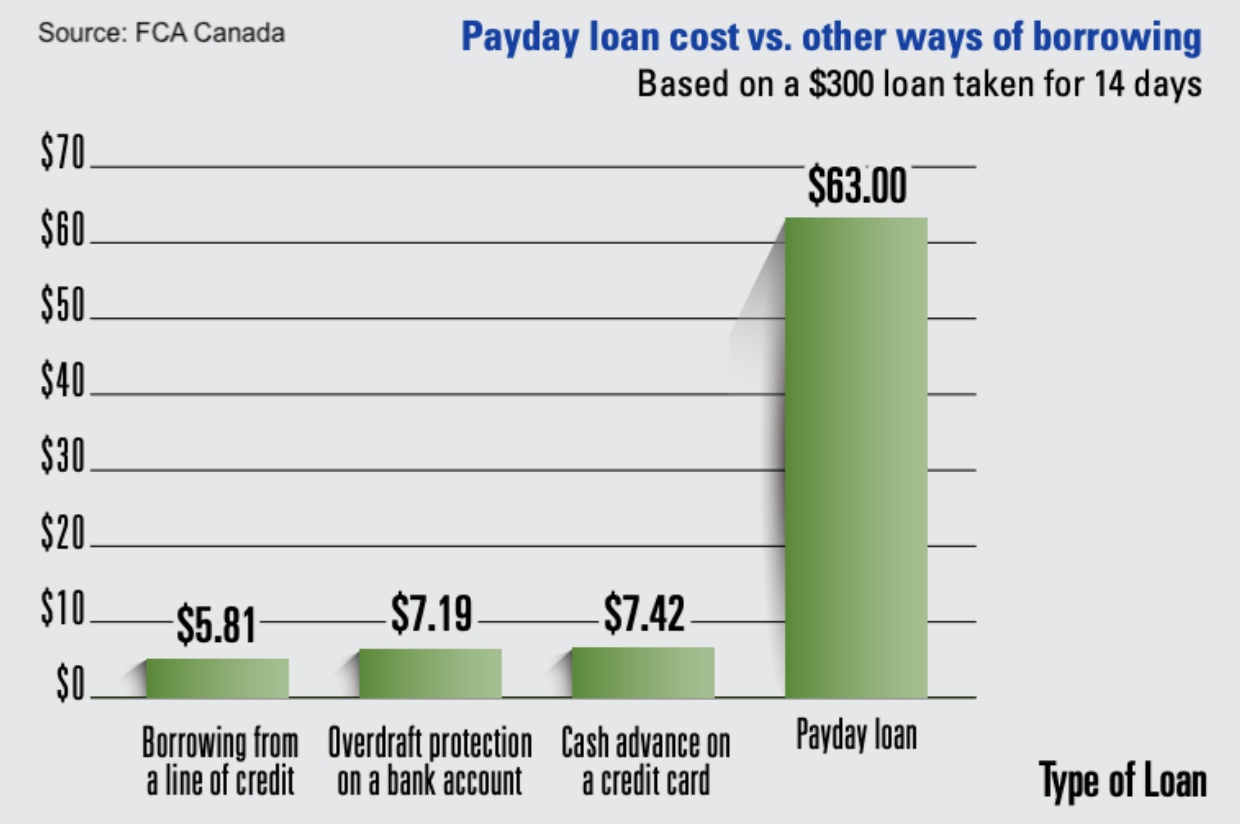

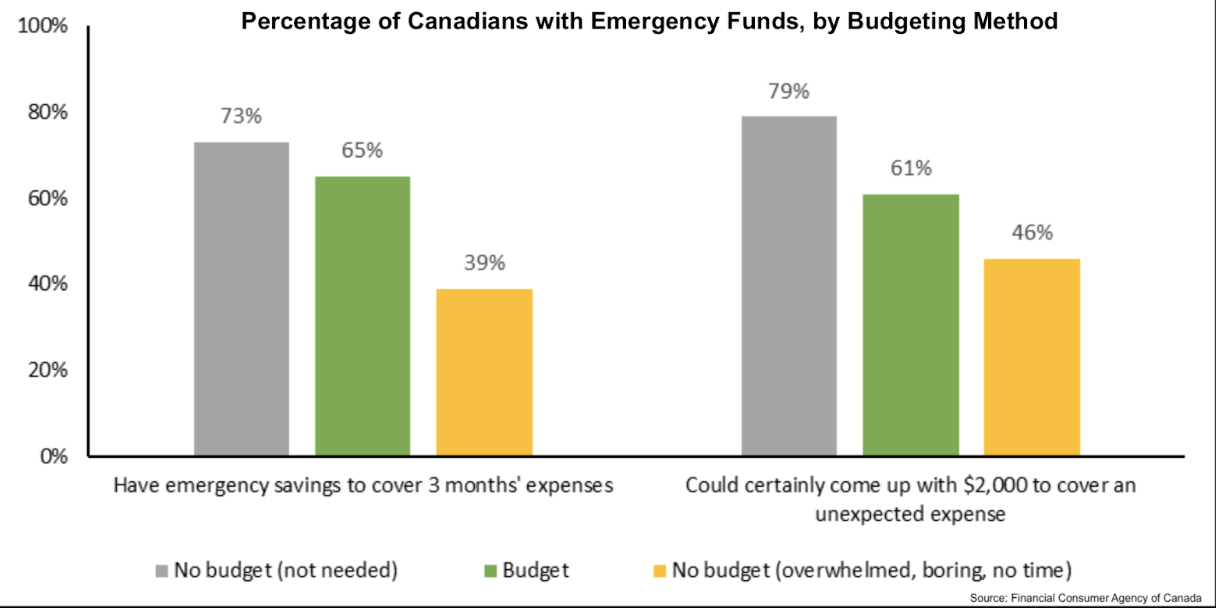

- Cost: No-credit-check loans carry heavier risk than loans for high credit, and as a result can be more expensive. It is important to understand all terms and fees when considering a loan offer, and set a proper plan to repay the loan without delay, to avoid more costs.

- Low borrowing amounts: The short-term, unsecured nature of no-credit-check loans means that they are smaller than other types of personal loans. Payday loans, for example, have a maximum loan value of $1,500.

- Do not help build credit: Making loan repayments on time can be an important step in rebuilding a bad credit score, but unfortunately payday lenders do not report positive payment behaviour to the credit bureaus. This means that repaying your payday loan properly will not have an impact on your long-term financial profile.

- Payday loan scams: Fraudulent and predatory companies and individuals can attempt to exploit ordinary people in need of money fast – most often via payday loan scams. While a payday loan or no-credit-check loan from a reputable company poses minimal risk, payday loan scams can threaten your finances significantly.

Alternatives to No-Credit-Check Loans

Canada is home to a thriving loans market that offers a wide variety of borrowing options, including:

- Unsecured installment loans

- Secured installment loans

- Guarantor loans

- Personal lines of credit

- Credit cards

- Overdrafts

- Debt consolidation loans

- Payment deferral programs

Any one of the above may be a suitable alternative to a no-credit-check loan, but it’s important to remember that not every option is suitable for every purpose, or for every person. It’s incumbent on each individual to understand their needs and situation, and to choose a loan – with all of its advantages and disadvantages – accordingly.

If you’re in need of fast cash from a trusted no-credit-check loan company, apply with us today. We’re transparent about how we work and are available to answer your questions at any time.