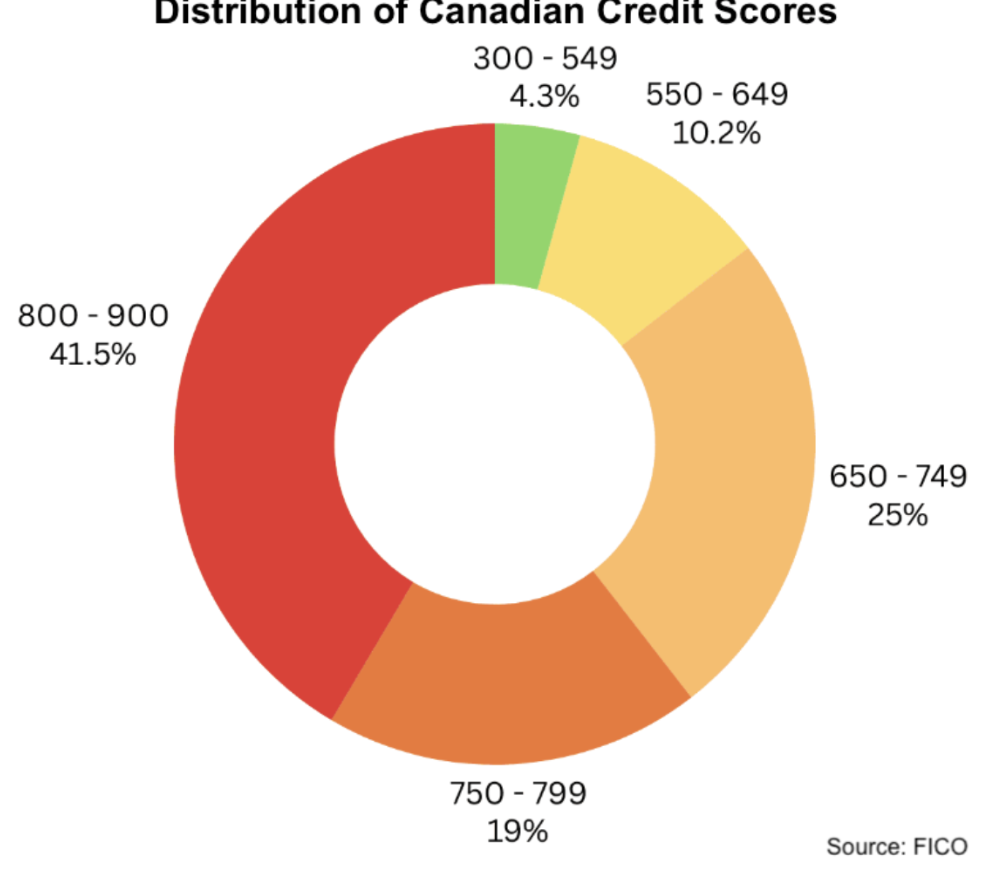

Over 14% of Canadians have bad credit – meaning some five and a half million of us struggle to qualify for financing. Failure to qualify for a loan doesn’t mean you stop needing one, though, and fortunately, there are some options for those in this difficult position:

Get a Bad Credit Loan

Traditional lenders, like banks and credit unions, don’t lend to anyone with a low credit score, so these borrowers need somewhere to turn; this need has created a dedicated, specialized loans market, driven by alternative and online lenders offering bad credit loans. Bad credit loans are geared to work for people with poor credit, and they can come in many forms (installment loans, lines of credit, short-term loans, auto loans, and so on).

No matter why your credit score is low, it won’t impact your ability to qualify for one of these loans. However, these loans do usually have other qualification criteria, such as income requirements, so they’re not without restrictions. And because lenders of bad credit loans are taking on more risk by lending to poor credit borrowers, they charge more in interest.

Every bad credit lender has their own costs, loan terms, and eligibility requirements, so it’s really important to shop around when considering a bad credit loan.

Get a No-Credit-Check Loan

An alternative to a bad credit loan is a no-credit-check loan. Many people confuse these two, but they’re not quite the same thing; a bad credit check loan is a loan to someone with bad credit. Their credit history may still be checked, but it won’t be a deciding factor in approval. A no-credit-check loan, on the other hand, totally eliminates the credit check portion of the borrower assessment. No-credit-check loans can be used by anyone; this includes people in a hurry and who don’t want to wait on a credit check, people with no credit history, and people with poor credit.

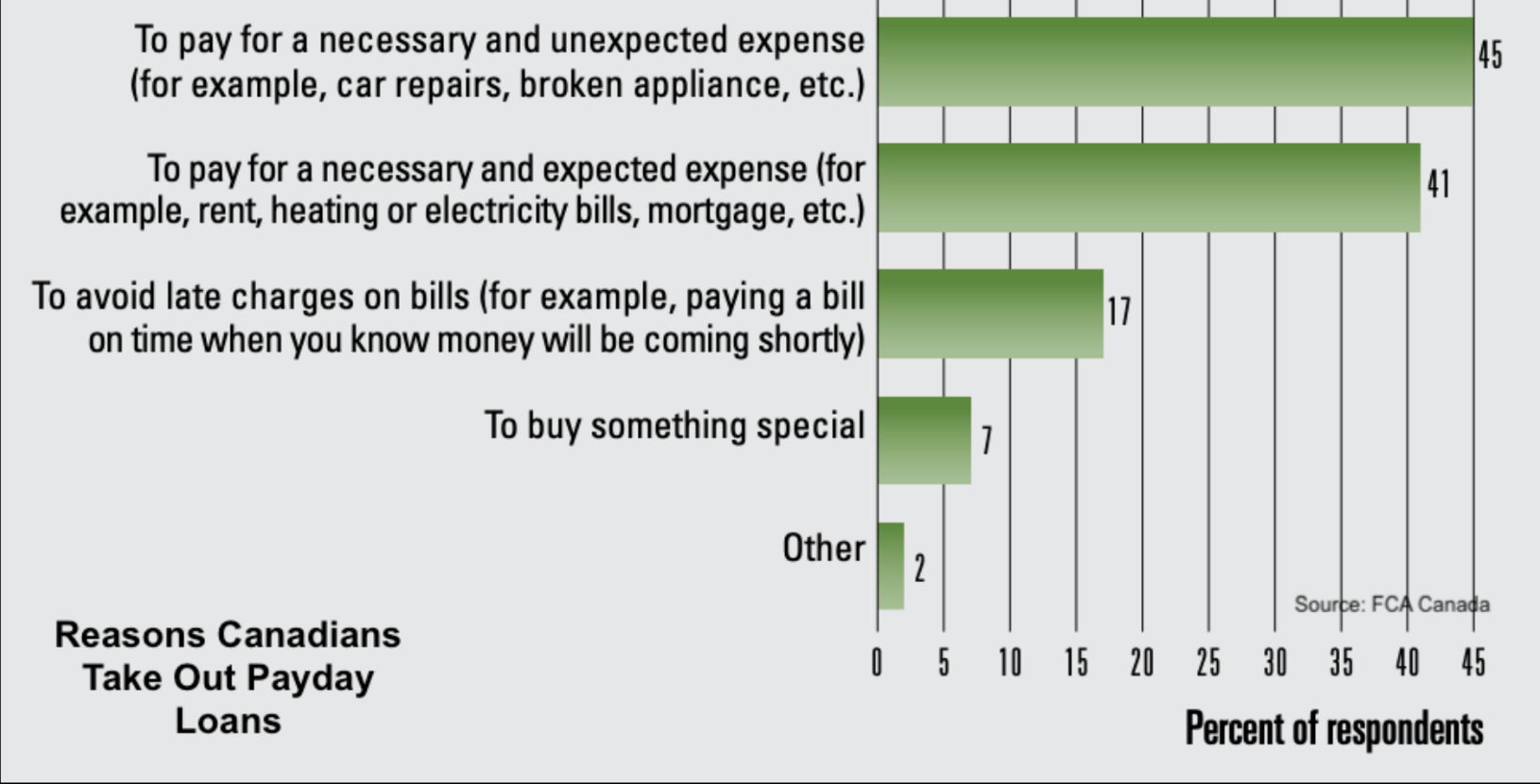

No-credit-check loans are often smaller than traditional personal loans, and they too may have income requirements. But many, such as payday loans, do not require employment income specifically; instead, any form of income can make a borrower eligible for a payday loan. Many no-credit-check lenders have online platforms where you can assess frequently asked questions such as costs, application requirements and loan terms. It’s important to do this due diligence, as not every no-credit-check lender is reputable.

Find a Loan Guarantor

Mainstream lenders refuse bad credit borrowers because they perceive them to be too risky to lend to; but borrowers can lower this risk by finding someone with good credit to co-sign for their loan. This co-signer, or guarantor, acts as a backstop in case the borrower fails to make their loan repayments, effectively transferring the risk away from the lender and onto the shoulders of the guarantor.

A good credit guarantor can make it significantly easier for bad credit borrowers to access a wider range of loans, many of which may have more competitive terms and interest rates than designated bad credit loans. So this is a great option for those with a friend or family member willing to help them out.

Use an Asset as Loan Collateral

Another way to lower a lender’s risk is by offering loan security. Here’s how it works: if you have a valuable asset, such as a property, you can use it as loan collateral. This means that if you default on your loan, the lender can seize the asset in lieu of payment – ensuring they still get compensated. This certainty means lenders are less reliant on credit score when assessing borrowers, and so those with bad credit have more of a chance of qualifying for a loan. Secured loans tend to have better terms than unsecured loans, so this is a great option if you have an asset in your name; however, it’s important to remember that if you default on a secured loan, you will lose the asset.

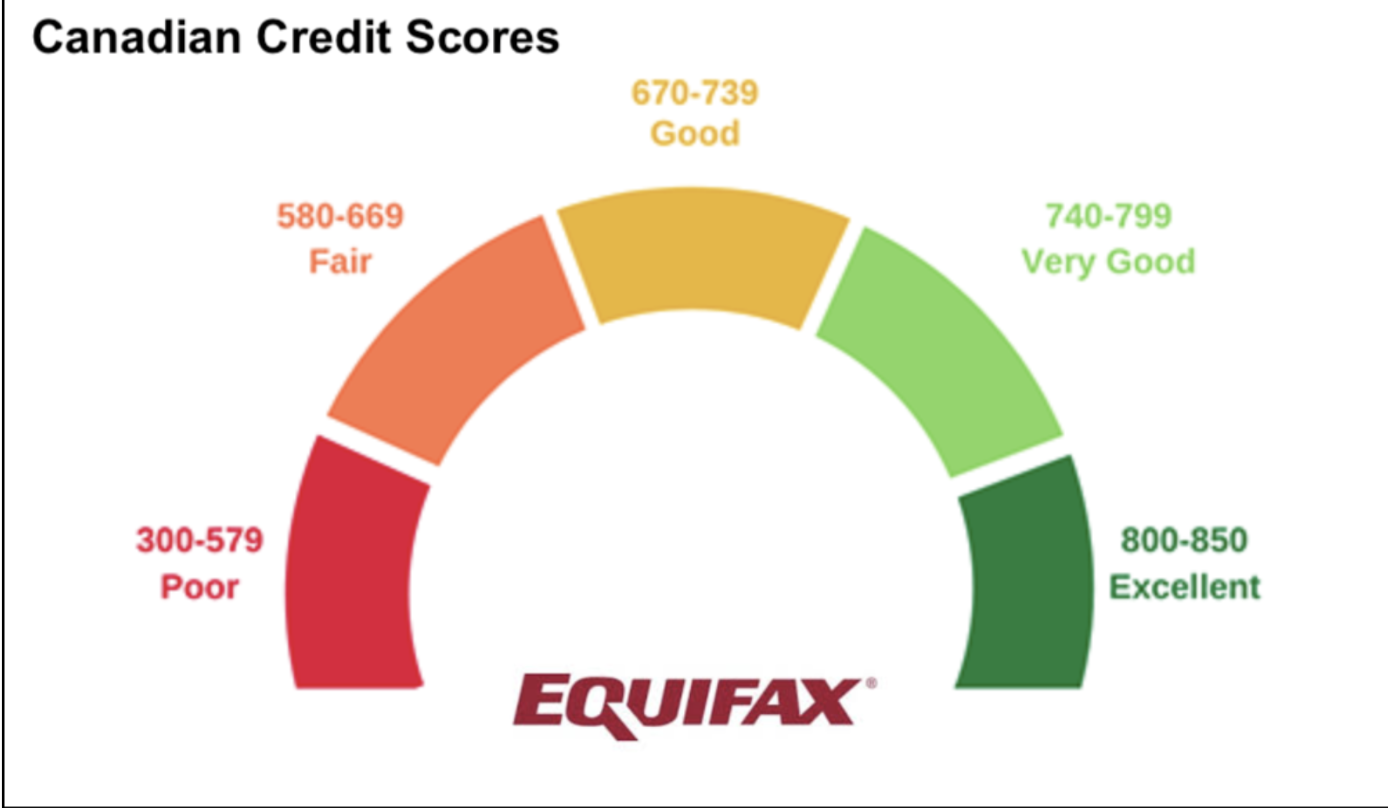

Improve Your Credit Score

A bad credit score need not be permanent; there are many ways to improve your credit and make it easier to qualify for loans in the future. This includes:

- Checking your credit report for errors

- Paying all your bills on time

- Reducing the amount of debt you hold

- Closing inactive financial accounts

- Limiting new credit applications

For more information on how to access quick, convenient financing today, without the hassle of a credit check, find out how we work, or contact us directly.