If you need money in a hurry, then like millions of other Canadians, you’ve probably thought about getting a payday loan. These short-term, no-credit-check loans can provide vital financial relief, but there’s a lot of misinformation out there about how they work and who can get one. So let’s break down exactly what you need to know:

Step One: Apply

Who Can Apply for a Payday Loan?

The requirements to get a payday loan in Canada are very simple, making them one of the most accessible forms of financing. All you need is:

- To be at least 18 years of age

- To be a Canadian permanent resident or citizen

- To have an active Canadian bank account

- To have some form of income (employment, unemployment benefits)

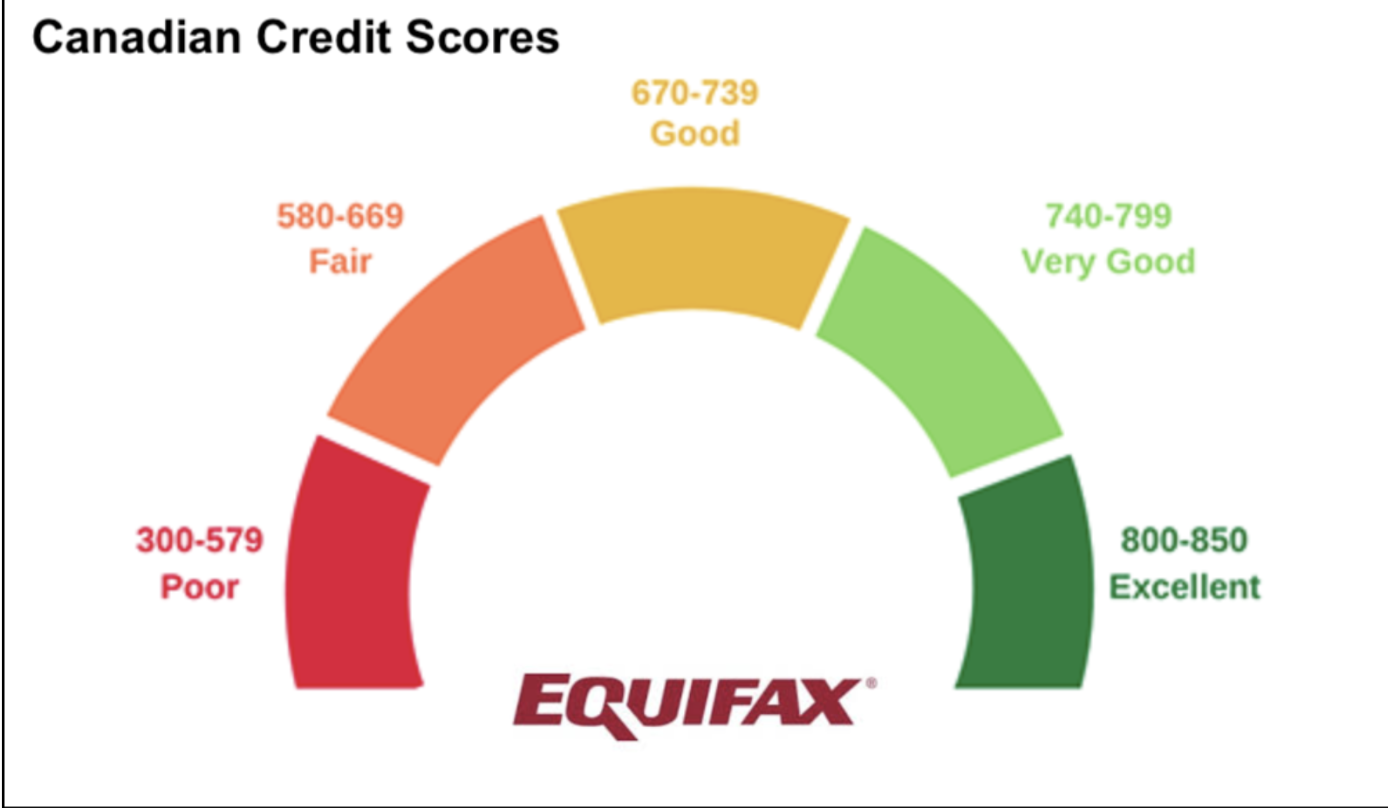

And that’s it. You don’t need to worry about your credit, as no credit checks are performed in the assessment of payday loan applications. You don’t have to be permanently employed, as most forms of regular income makes you eligible, including unemployment benefits. And you don’t have to have any assets to act as loan collateral, as these are unsecured loans.

How to Apply for a Payday Loan?

Most payday lenders offer online application and payment systems which mean you can apply for, receive, and repay your payday loan, all entirely at your own convenience. All you need to do is navigate to your chosen lender’s website and click on “Apply”. If you’d rather do it in person, though, many payday lenders have physical locations in urban centres.

In order to complete an application, you’ll need a few things:

- Canadian-issued ID

- Complete an Instant Bank Verification

- Paystubs or other proof of income

When completing an online application, you’ll need electronic copies of these items. To make sure your data is safe, most reputable payday lenders use secure systems, such as Instant Bank Verification, to handle sensitive digital information.

Where to Apply for a Payday Loan?

Payday loans are regulated both federally and provincially, which means that you need to find a payday lender that operates within your home province. Every province and territory in Canada has multiple lenders; make sure when choosing a lender that they: are licensed; have secure digital systems; have a solid reputation; and are clear in their terms and costs. Some lenders also opt for their own borrower requirements, in addition to those stated above (such as a minimum income threshold), so check these too before applying anywhere.

What are the Rules for Payday Loans?

The laws around payday loans are strict; you cannot borrow more than $1,500, and you must repay the funds within 62 days. The amount a payday lender can charge you in fees and interest is capped by federal regulations. All of this regulation is geared to help protect Canadians from excessive borrowing costs.

Step Two: Wait… But Not for Long

Once you have chosen a lender and completed an application with them, they need to process it. One of the primary reasons payday loans are popular with those in need of emergency funds is that they’re so much quicker to get than any other type of loan. The lender simply needs to verify the information you provided in your application, so many receive funds within just a few hours of applying, and most lenders have a turnaround time of just a day.

Step Three: Receive Funds

As you will have provided bank account details in your application, it is trivial for your payday loan funds to be deposited directly into your account as soon as they are approved. You can then use these funds in any way you like.

Step Four: Repay Your Loan

As with any type of loan, a payday loan needs to be repaid. The method by which this happens will have been agreed during your application; the most common option is usually a an E-transfer on a set date. It is not permitted for a payday lender to take your loan repayment directly from your wages.

You can of course choose to repay your payday loan early if you wish. On the other hand, if you are unable to repay your payday loan by the agreed-upon date, then you’ll start to accrue extra fees and interest on your loan – much like you would on any other form of financing.

And that’s how it works! It really is that simple. And no other form of borrowing provides such easy and fast access to cash. Learn more about payday loans in our FAQ, or contact us to discuss your borrowing options.