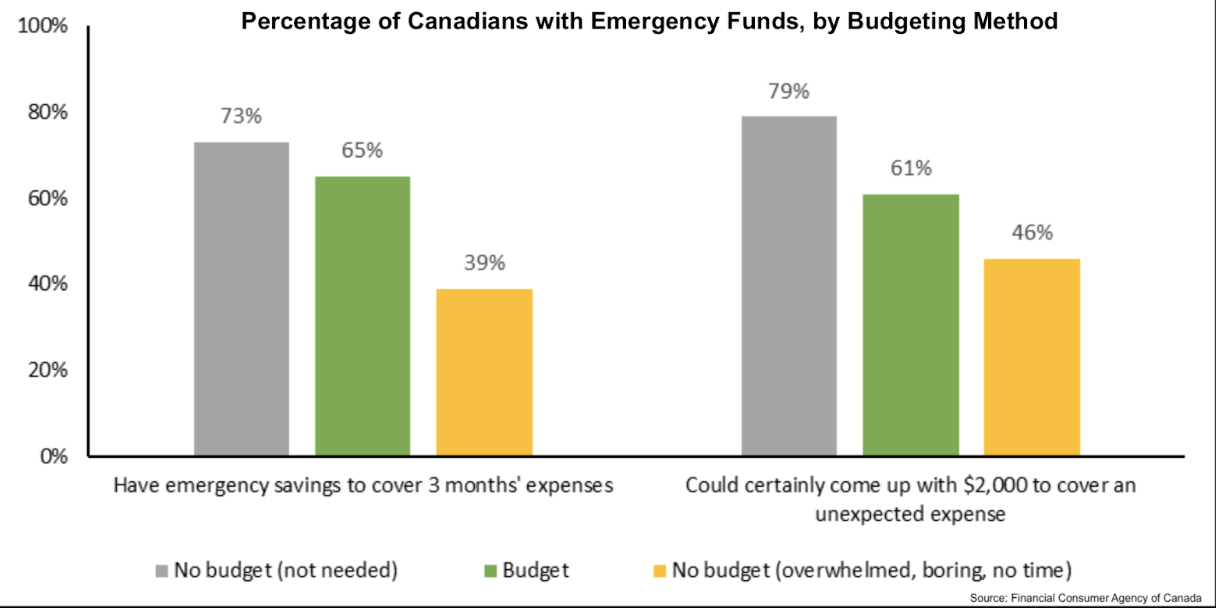

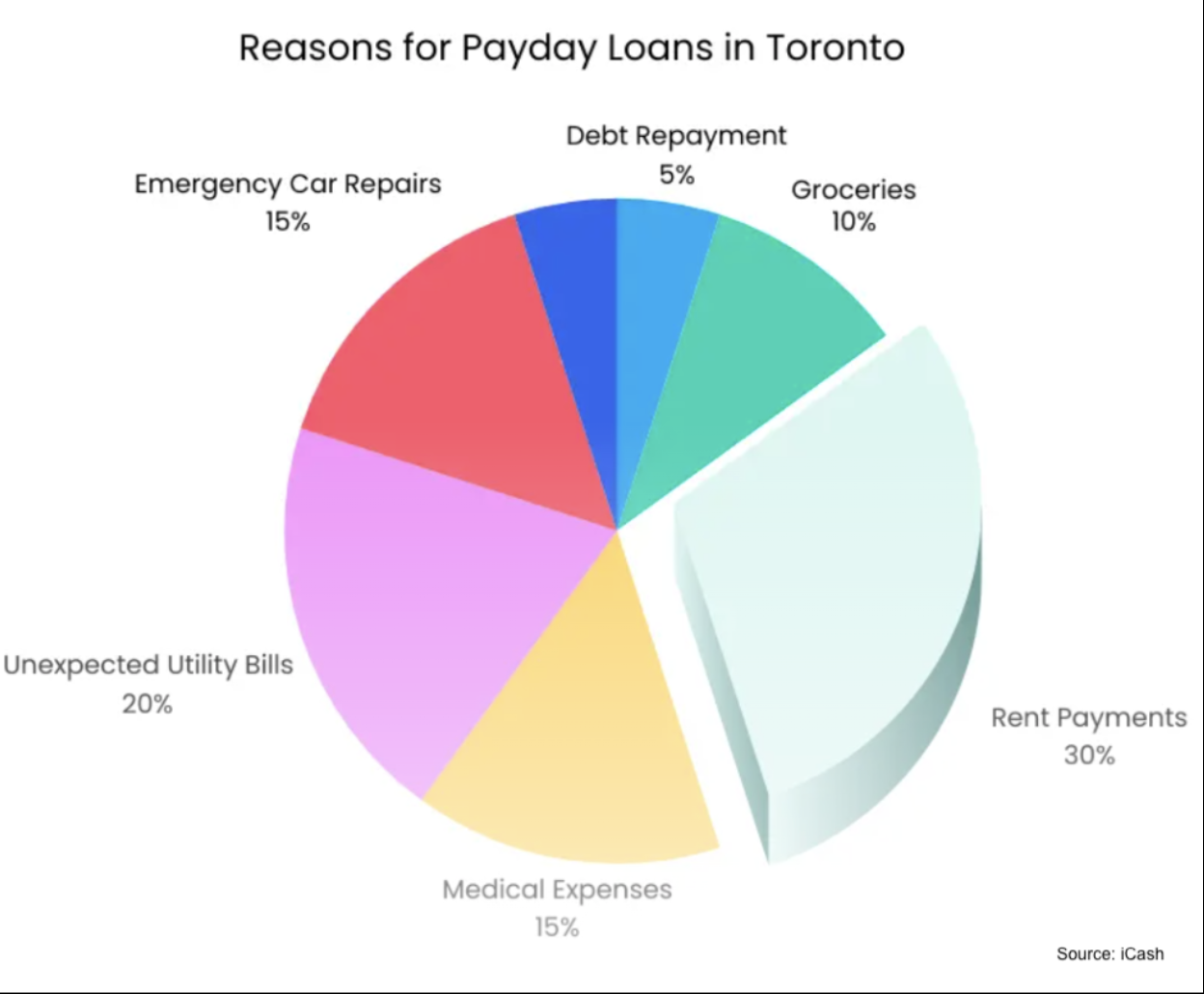

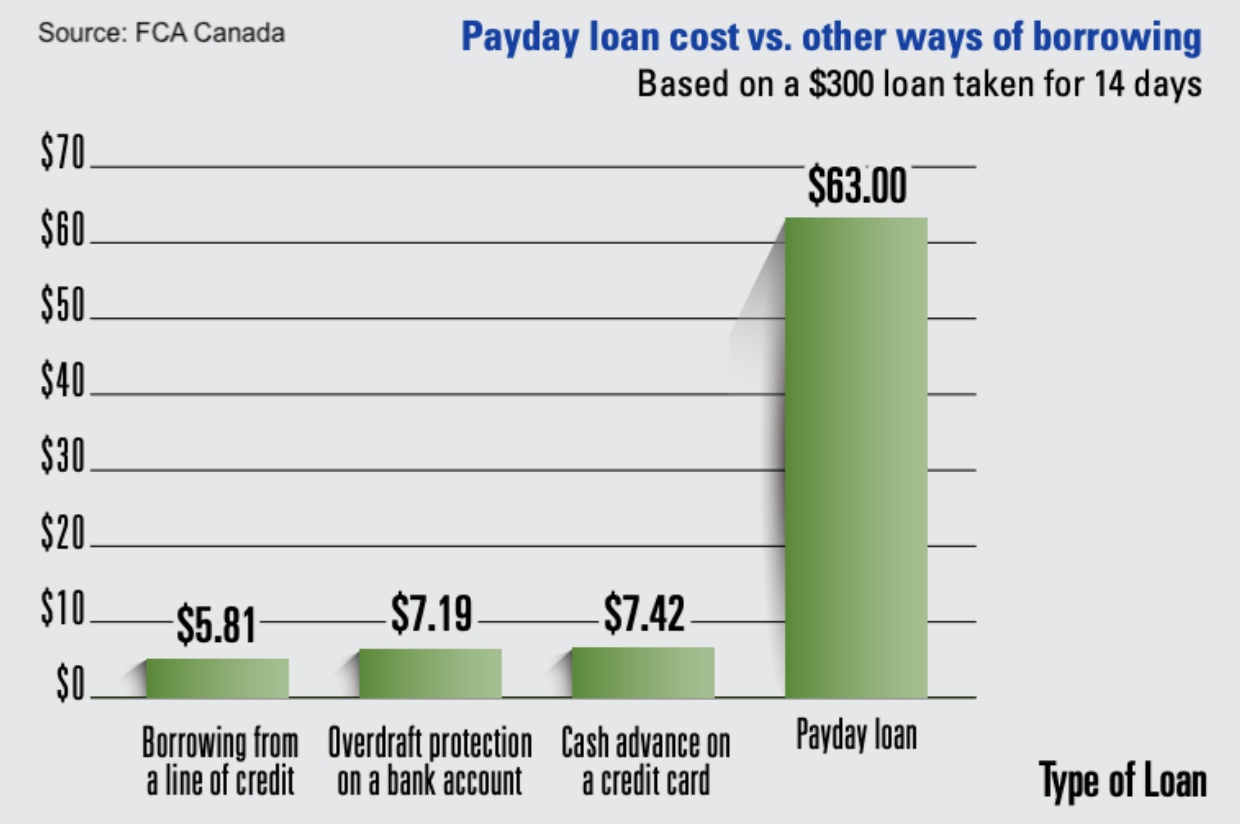

Emergencies can happen to anyone, at any time, and having some money put aside to get you through difficult times can be extremely helpful. But a third of Canadians don’t have an emergency fund to fall back on, leaving them reliant on short-term loans and paying for the privilege. And while short-term loans, like payday loans, can provide vital assistance in times of need, they shouldn’t be the only tool at your disposal. So here’s how you can build yourself an emergency fund after using a payday loan:

Step 1: Repay Your Payday Loan

The first step in re-establishing your financial footing is to pay off your short-term debts, including any payday loans you have outstanding. While it may have helped you through a recent emergency, allowing a payday loan to collect interest will only further hamper your finances, so repayment should be a priority – before you start saving.

Step 2: Take a Good Look At Your Finances

With your most immediate debt taken care of, you now need to properly understand the state of the rest of your finances. Information is key – you can’t be expected to save anything if you don’t know how much money you have or where it gets spent. So write down:

- Your monthly income (from any and all sources, including benefits)

- Your unavoidable monthly expenses, such as:

- Rent/mortgage payments

- Utility bills

- Groceries

- Transport costs

- Healthcare costs

- Insurance

- Other debt repayments (e.g. credit card repayments)

- Your discretionary expenses, such as:

- Eating out/takeout

- Memberships and subscriptions

- Entertainment costs

- Vacations

- Hobby-related expenses

Looking through past bank statements (which is very easy to do if you have online or app-based banking) will help you to get a breakdown of some of these numbers.

Ideally, your total income minus your total outgoings should leave you with a little excess that can be saved each month, but many people struggle to achieve this balance without a budget. That’s where Step 3 comes in.

Step 3: Create a Budget and a Monthly Savings Target

Now you have all the information you need, you can make some decisions. There are a few ways to approach your savings strategy: some people opt to eliminate all of their discretionary expenses, and funnel the money saved directly into a savings account. Others work on reducing expenses across the board, including on essential items like utilities, to garner savings in as many places as possible. The right strategy for you depends on your lifestyle and needs, but the key is to take steps that will leave you with that all-important monthly excess.

Once you’ve reduced your outgoings to provide room for savings, you need to create a monthly budget. This budget will inform you how much per month you can realistically save. Most experts recommend having three months’ worth of expenses saved as an emergency fund; you can calculate how long it will take you to reach this goal by dividing what this number is for you by how much you can save monthly.

Step 4: Utilize Automatic Payments and Rewards Accounts

Open a dedicated savings account for your emergency fund, and use automatic transfers to wire your monthly savings into it. This will help you stick to your plan and avoid spending the savings elsewhere. Some accounts come with perks that might help you reach your goal faster, but don’t pay too much for these – that defeats the point. You can however make liberal use of rewards programs and cash back associated with your bank, your credit card, or the individual stores you shop at. If you have to spend money, make it work as hard as possible for you!

Step 5: Monitor Your Progress

Even the best-laid plans need occasional fine-tuning; monitor your progress and adjust according to the realities of your day-to-day. Every few months, look at how much you’ve spent versus your budget, and see where the discrepancies lie. A good financial plan is not based on rigidity, but on flexibility, so small corrections and amendments to your budget, while sticking to the overall goal of saving, is more likely to work over the long-term.

If you’re facing an emergency but haven’t had the chance to build your emergency fund yet, Magical Cash can help. Contact us to find out how much you can borrow, or apply online for a quick loan decision.