Over 1.5 million people will turn to payday loans in the next three months – many because these instruments don’t rely as heavily on credit as other types of loans. But just because this form of financing is available to those with bad credit, it doesn’t mean credit and payday loans don’t impact each other. Let’s take a look at how they interact:

Do payday lenders check your credit?

Let’s start at the beginning: needing a loan. All traditional lenders (like banks and credit unions) and many alternative lenders rely on credit checks when assessing loan applicants. But most payday lenders don’t. This is not to say that all payday lenders forego credit checks, but the general pattern across the industry is to go without. This is why payday loans are considered such a vital option for Canadians with bad credit, no credit history, or those wanting to avoid a check on their credit report.

Quick read: what is a credit report?

All Canadian consumers over the age of 18 have a credit report; this is a detailed history of their financial behaviour, compiled with data from banks, lenders, other financial organizations, and public records. It shows a person’s amount, types, and use of debt, bill and loan payment histories, personal data, and other pertinent information.

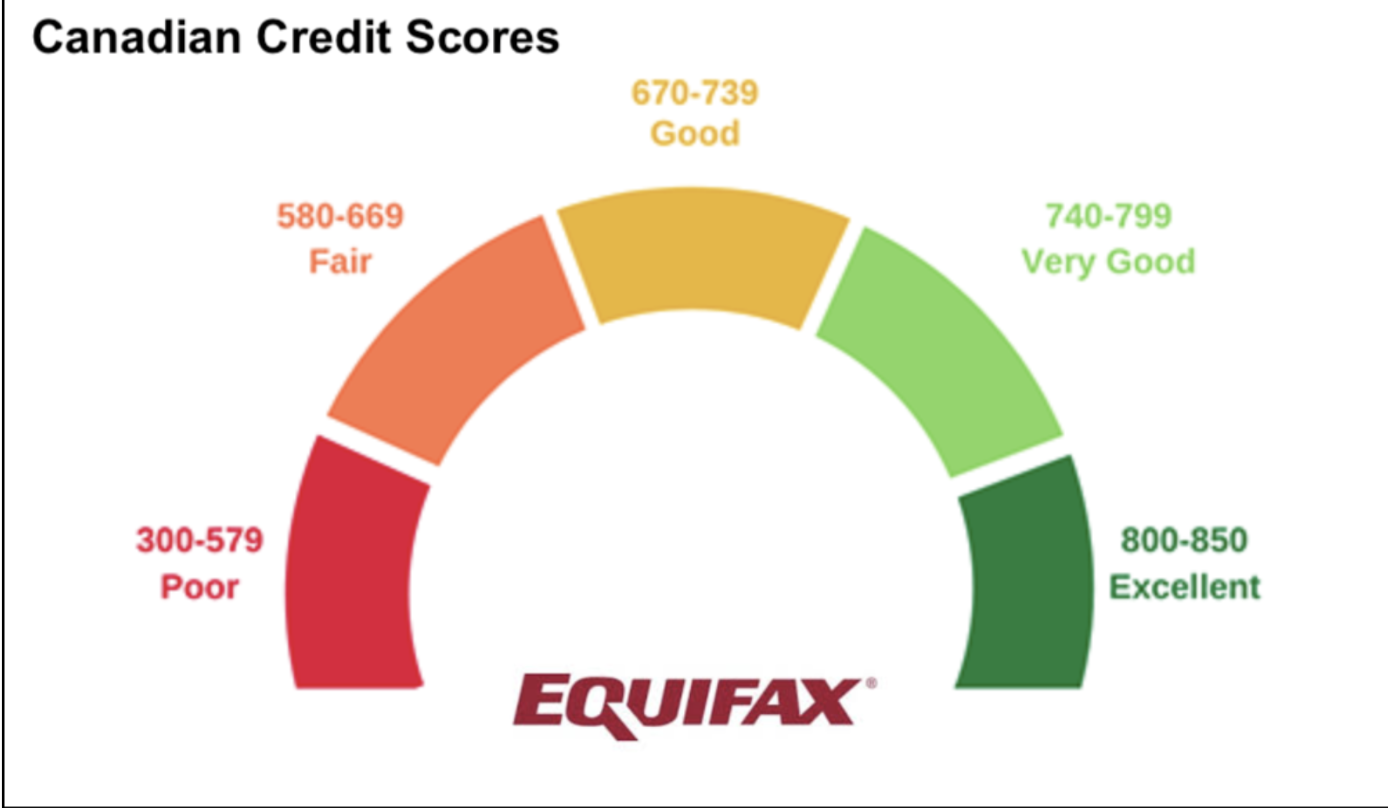

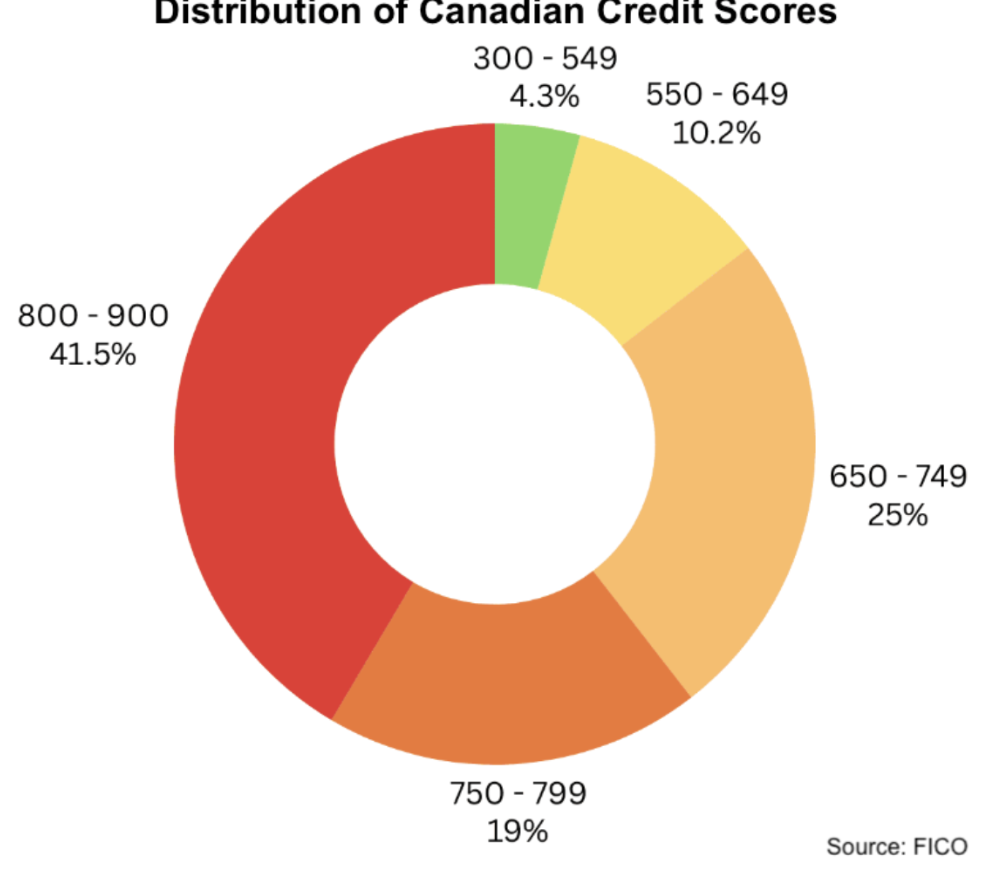

All of this data is distilled into a single three-digit number, known as a credit score, that represents a person’s creditworthiness. Lenders use credit reports and more specifically credit scores to assess how financially trustworthy a person is, and whether they want to lend money to them.

If payday lenders don’t check credit, what do they check?

In the absence of a credit check, payday lenders rely on income when assessing applicants. This does not necessarily have to be employment income, but it must be provable, consistent income of some kind. Examples of qualifying income can include:

- Employment insurance (EI)

- Workplace Safety and Insurance Board (WSIB) payments

- Canada Child Benefit (CCB) payments

- Ontario Disability Support Program (ODSP) payments

- Canadian Pension Plan (CPP) payments

- Old Age Security (OAS) payments

- Other pension income

- Asset-based income

Most payday lenders will ask to see three months’ worth of income statements and bank statements, as well as Canadian-issued I.D. and proof of address. Some may have minimum income thresholds as well, but this varies from lender to lender; you can find out more about our requirements in our FAQ.

Does getting a payday loan harm your credit?

Most people getting a loan only think about how their credit will affect their ability to access products, but there is a whole other side to the equation. Actually holding debt can itself impact your credit score, as too can your debt repayment behaviour. Remember, your credit report includes details on how much debt you have and your loan payment history.

This is true for almost all types of loans, because lenders report consumer behaviour to the credit bureaus responsible for collecting and compiling this data. But here’s the good news: payday lenders do not do this for every person who takes out a payday loan. This is partly because payday loans are such short-term products, and partly because they are for such small amounts.

So the acts of applying for, getting, and holding a payday loan have zero impact on your credit.

How does repaying a payday loan affect credit?

All of this may leave you thinking that payday loans and credit have nothing to do with each other, but that’s not entirely true. If you are late with or miss your payday loan repayment, it will trigger a collection process so the payday lender can recoup their funds. This, in turn, will be reported to the credit bureaus, and it will have a negative impact on your credit. So, as with any other type of debt, you must repay your payday loan according to the loan agreement to avoid any negative credit consequences.

Unfortunately, the flip side of this does not apply. One way to rebuild a poor credit history is to establish a pattern of good financial behaviour, such as repaying debts on time. Some people achieve this by taking out a loan and then dutifully repaying it properly. However, a history of positive repayment of your payday loans will not be reported to the credit bureaus, and so will not make any difference to your credit report or credit score. So, payday loans cannot be used to help build credit in the way that other types of loans can.

Find out more information about payday loans on our blog, or contact us with your questions. And if you need cash fast, apply online for a decision in minutes.