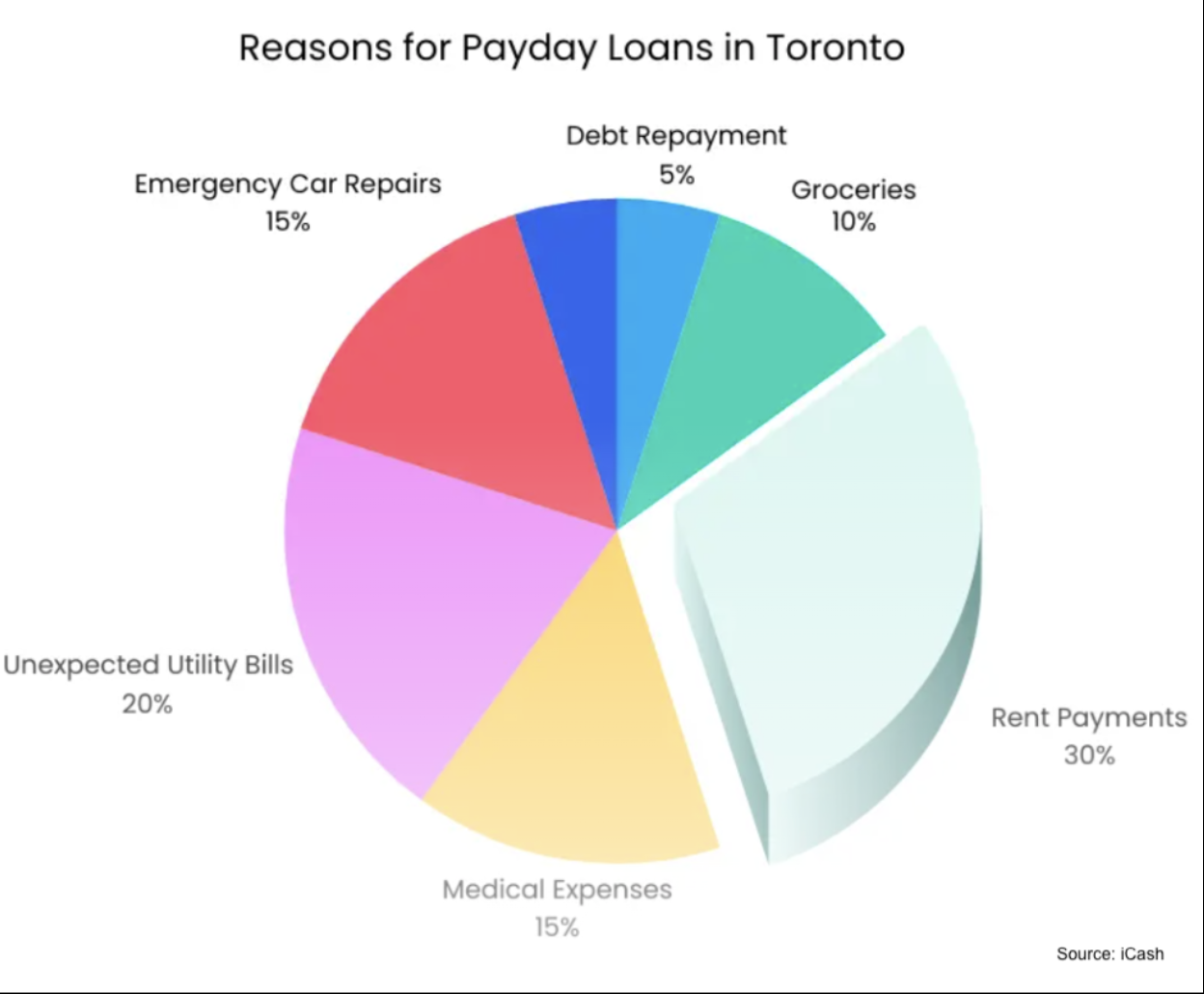

Torontonians face myriad financial pressures, and sometimes need a little extra help to get to the end of the month. Luckily, payday loans are widely available throughout the city; here’s how to get approved for one:

Meet the Basic Criteria

Payday loans are among the easiest types of financing in Toronto to qualify for; all you need is to be at least 18 and to have:

- Legal residence in the country

- An active Canadian bank account

- Income

The income required does not necessarily have to be employment income; different payday lenders vary, but many accept other forms of income, including EI, WSIB, ODSP, CPP, OAS, CCB and so on. What matters is that you have regular money coming in.

Gather Your Paperwork

As most residents of Toronto meet these basic criteria, the next thing to worry about is proving it. When completing an application form for a Toronto payday loan, you’ll need to provide:

- Canadian-issued ID

- Bank statements or Instant Bank Verification

- Proof of income (e.g. paystubs)

As many payday lenders have online application systems, having these items in digital format can be a big help.

Pick a Lender

With your documents in hand, you’re almost ready to complete an application for a payday loan. But first, you need to pick a lender to apply with. There are two major areas of consideration when doing this:

- Qualification criteria

- Safety

Qualification Criteria

The basic qualification criteria for payday loans, mentioned above, are consistent across the market, but individual lenders may have their own, additional criteria. A common one is a minimum income threshold. For example, Magical Cash has a minimum income threshold of $1,500 a month.

Another criteria to consider is location: lenders are regulated on a provincial level, meaning they have to be established in a province before they can lend to a resident of that province. This isn’t an issue if you go to a payday loan store in Toronto, but if looking for a lender online, you need to make sure they operate in Ontario. This information should be easily found on a lender’s website, along with other information on how they work.

Safety

Unfortunately, although there are many reputable payday loan companies operating in Toronto (and wider Ontario), there are also fraudulent companies looking to exploit or overcharge people. Payday loan scams are becoming more common, so it’s vital you protect yourself and your finances by picking a lender that is trustworthy, established, with a history of satisfied customers, and robust security measures.

Complete an Application

Once you’ve found a lender whose eligibility rules you meet and whom you can trust, you’re ready to apply with them. Online application systems are common and easy-to-use, allowing you to complete and submit your paperwork in minutes.

To ensure quick approval, you need to complete the application form in full and as accurately as possible. Don’t leave fields empty, or forget to attach any supporting documentation asked for – this will only slow down the process.

Assuming you’ve done everything properly and that you meet the lender’s criteria, you should receive a decision very quickly. Most lenders offer turnaround within one day, but many borrowers get a loan decision in just a few minutes.

You’re Approved! Now What?

Once that all-important loan approval comes through, it’ll take no time at all for your payday loan funds to be released. Most lenders will transfer funds directly into your bank account (remember, you gave them the details when you applied), and you’ll be able to use the money within 24 hours.

After you receive the funds, you’ll have a maximum of 62 days to pay it back, but most repay much sooner than this, according to the agreement made when applying for the loan. Repayment can happen in a few different ways, but in most cases funds are automatically withdrawn on due date.. Once your payday loan is repaid, you are free to apply for another one anytime you need.

Learn more about how to get a payday loan, or contact us to discover what a dedicated, trusted Ontario-based lender can do for you.